In the middle of the year, we have decided to compare the data of the year 2022 extracted in the Assalco-Zoomark report with other important studies to for highlighting the expected future trends.

You can download from our newsletter the full version of Assalco-Zoomark report presented at Zoomark 2023.

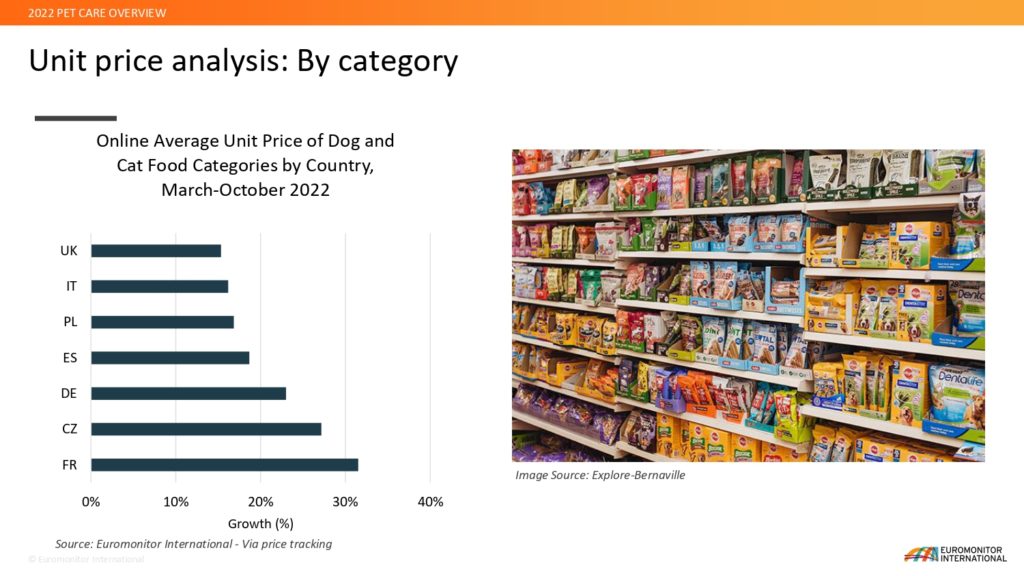

Prices are increasing in Europe but Italy seems to be the most virtuous country

Despite the drop in prices of raw materials and in energy market compared to the first months of 2022, the economic shock deriving from the persistent political-economic instability does not yet allow a drop in prices. In comparison with the main European markets, the pet care sector (which also includes pet food) had a more contained increase in prices in Italy and the UK; higher increase have been measured in other countries such as Czech Republic and France where it reaches an average of over 30%.

Despite the drop in prices of raw materials and in energy market compared to the first months of 2022, the economic shock deriving from the persistent political-economic instability does not yet allow a drop in prices. In comparison with the main European markets, the pet care sector (which also includes pet food) had a more contained increase in prices in Italy and the UK; higher increase have been measured in other countries such as Czech Republic and France where it reaches an average of over 30%.

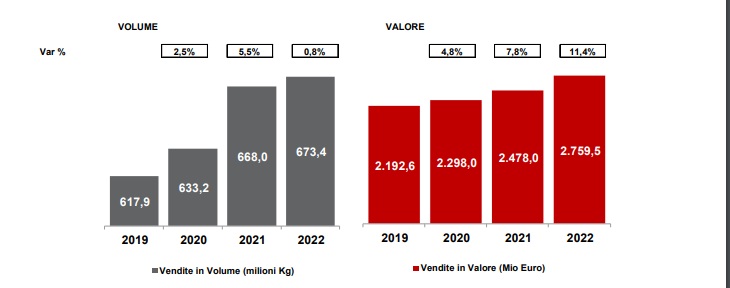

Another important data concerns the quantity of petfood products that have been introduced on the market with +6% despite the stop between February and April of last year. A data confirmed by Assalco-Zoomark 2023 report which confirms how the resilience of Italian pet food companies has also made them more competitive in  terms of margins and prices compared to other international players with a double-digit increase in value which is driven also by a slight increase in volumes.

terms of margins and prices compared to other international players with a double-digit increase in value which is driven also by a slight increase in volumes.

Trends for the next 5 years based on the acquired data

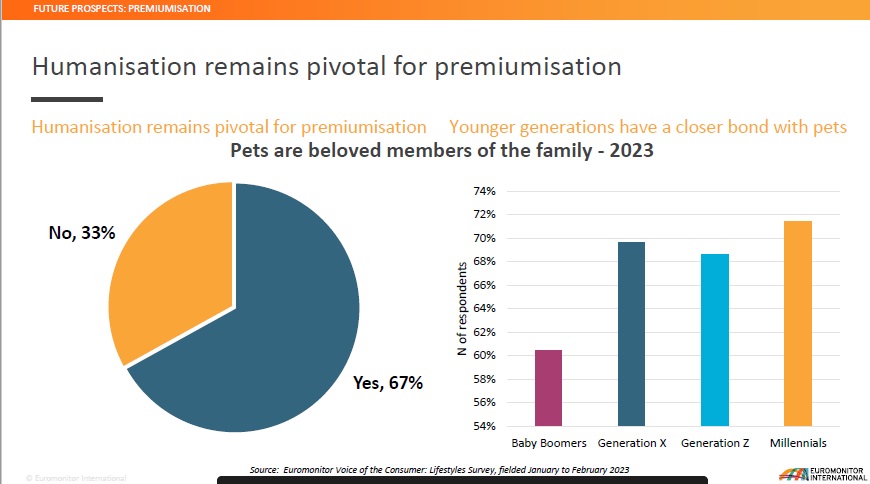

Euromonitor analyses highlights the differences in purchasing behavior and the sales channels use. Pets are increasingly considered members of families with a difference between Millennials (1981-1996) and Generation Z (1997-2012), a little less sensitive to this issue even than Generation X (1965-1980)

Another important data concerns the overall value and therefore the margins for resellers and distributors relating to various pet food segments. The growth in value of the economic product is increasingly slower than in the intermediate and high-value segments.

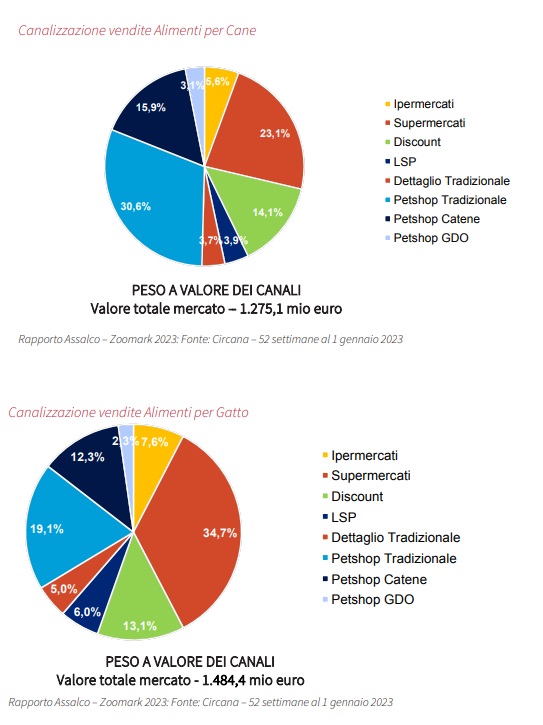

According to the Assalco-Zoomark Report 2023 despite the lower percentage increase in prices, there has been a rationalization in the offer to the public in pet shops, while in the large-scale distribution the introduction of new lines has led to very more sustained. Overall, if the large-scale distribution continues the growth in volumes, the traditional channel brings with it the growth in value of the entire sector with the Northern Italy area which generates alone 54% of the entire value of the national market.

According to the Assalco-Zoomark Report 2023 despite the lower percentage increase in prices, there has been a rationalization in the offer to the public in pet shops, while in the large-scale distribution the introduction of new lines has led to very more sustained. Overall, if the large-scale distribution continues the growth in volumes, the traditional channel brings with it the growth in value of the entire sector with the Northern Italy area which generates alone 54% of the entire value of the national market.

Pet parents behavior

Among the news recently emerged in the world of pet nutrition,,

a special interest is confirmed for products enriched in Omega 3 or vitamins (indicated by 3 out of 4 cat owners and by over 80% of dog owners), for

functional food, specific for animal problems (78% and 75%) and for products with only natural preservatives

(76% and 81%).

After all, pet owners appear reluctant to change their purchasing habits. In recent months, 25% of respondents with a cat and 19% of respondents with a dog did not change their behavior at all, while 37% and 32% continued to buy their usual products taking advantage from offers or looking for special promotions and 23% in both categories shopped in bulk for getting discounts. Mentions to discounters come mostly from dog owners (21%).